Law on Protection of the Value of Turkish Currency Exchange rate risks, a common question for all exporters, have become a common problem for all companies since the decision numbered 32 was published. Communiqué that entered into force by being published in the Official Gazette on September 4, 2018;

"The fees related to the export transactions carried out by the persons residing in Turkey are transferred or brought directly and without delay to the bank intermediating the export following the payment of the importer. The period for bringing the fees to the country cannot exceed 180 days from the actual export date. must be sold to the bank. says.

This situation brings with it exchange rate risks especially for the companies whose raw materials are imported and/or who are indebted in foreign currency and whose payments are indexed to foreign currency. The rapid increase in foreign exchange, especially in the last period, Changes in the dollar and euro Conversion to Turkish Lira becomes mandatory after the collection of export costs, has seriously strengthened the risk of loss of companies.

Solution: Hedging to Hedge Currency Risks What is hedging and how can it be done?

Currency Hedging is the transactions carried out by the foreign exchange traders (imports and exporters) in the forward markets to cover the exchange rate risk. The purpose of applying this process is to prevent individuals or institutions from being adversely affected by changes in exchange rates in the future.

Exporters should now 'hedging' to guarantee currency risk.

With hedging, exporters can eliminate the exchange rate risks by giving the banks a resale order of the Turkish Lira at the rate they will agree on (in terms of paying the foreign exchange debts) as of the moment they convert the foreign currency they bring into Turkish Lira in accordance with the relevant communiqué.

Exporters, who close their debts with the foreign currency inputs they receive, thus protect themselves against the exchange rate risk. When the Communiqué is examined from the point of view of importers before it comes into force, it is seen that more devaluation expectation is used for hedging. at times was being applied. Again, before the communiqué, the main purpose of the hedging process, in which the importers are interested when the exchange rates are rising, and the exporters are generally interested when the exchange rates are falling, is not to be adversely affected by the changes in the exchange rates. After the Communiqué came into force, the management of currency risks became much more critical.

An Effective Tracking System Should Be Established To Manage All These Risks

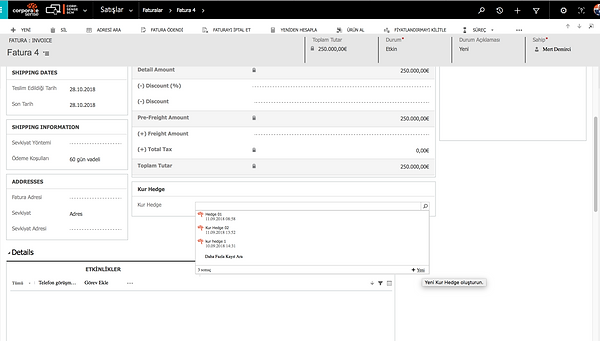

The system to be established should enable you to follow the hedge transactions you have made on the basis of invoices and allow you to instantly see how many positions you have taken for which invoice, at which payment term. All export invoices You must be able to associate your and hedge transactions with each other and be automatically informed by your system before the transaction due dates. In particular, you must hedge your risks before the end of your 180-day period, as required by law. It is critical that your current system automatically informs you when you consider the workload and risks that will be created by following this in our current works.

Example: How Currency Hedging Can Be Done and How the System Works

Let's assume that your export invoice of 250,000 Euros is issued with a 60-day maturity and paid on due date. After this amount is collected, it must be sold to the bank in accordance with the new communiqué. Let's assume that the exchange rate of Eur/TL on the relevant date is 7,501. In this case, when 250,000 Euros is sold to the bank, 1,875,250 TL will be collected.

The exporter, who will be worried about the decrease in the Euro equivalent with the increase in the Euro/TL exchange rate of this figure, will incur losses from the exchange rate changes, especially if they have payments in Euro.

In this case, the exchange rate risks will be eliminated by placing a sales order for 1,875,300 TL, which was previously collected from the customer and converted to TL in accordance with the law, at a value date where Euro payments will be made, with the currency hedge transaction to be made.

Using a system will not only eliminate the risks of making erroneous transactions in such cases, but also has a critical importance in tracking which of the related invoices have been hedged and which have not yet been hedged.

Contact us to have an effective risk management system, and we will set up your cost-effective system for you that will become effective in a short time...